Can I Register My Company Tax In Labuan

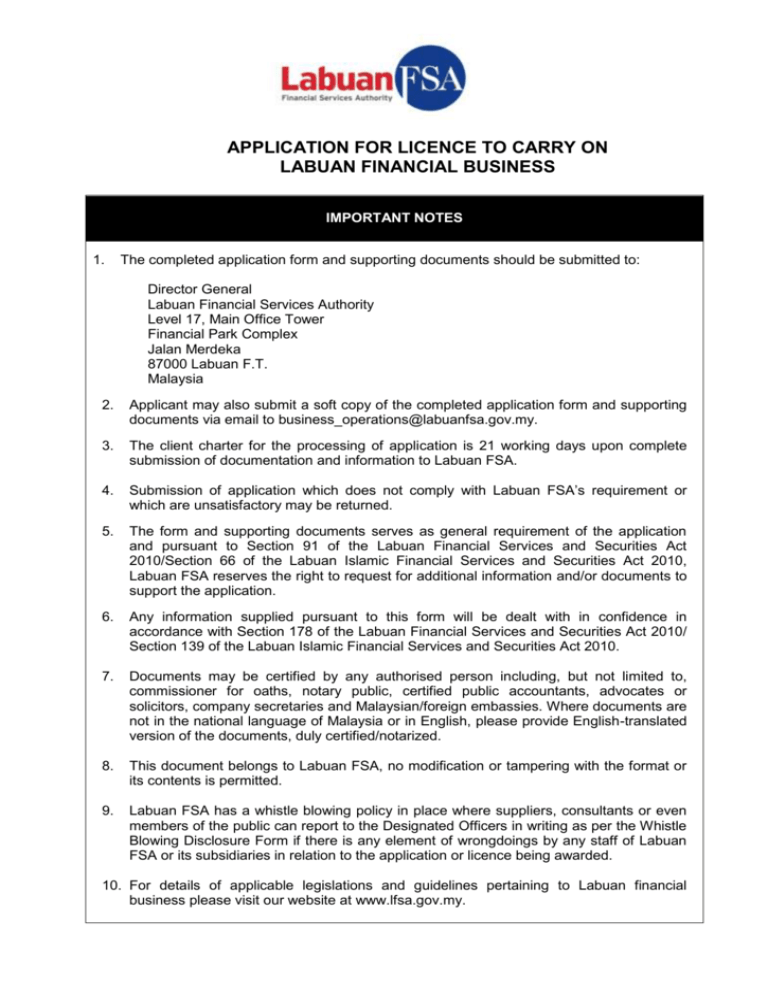

The first one refers to the registration of the business by submitting the needed documents followed by the application for Labuan business visa the opening of a bank account and the registration for tax. Apply for Labuan work permit dependent pass while working for a Labuan company.

Payment Services License In Labuan

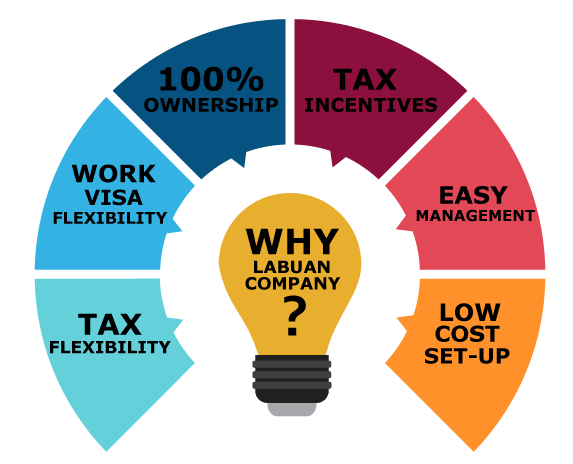

No personal income tax.

Can i register my company tax in labuan. For a Labuan offshore company a non-resident director is not required to pay personal income tax on director fees. Although Labuan is a federal territory within Malaysia there are preferential tax treatments for companies conducting Labuan business activities such as low fixed tax rate of 3 withholding tax exemption on payments to non-residents tax exemption on fees paid to non-. The registration procedure can be completed in a period of two weeks and the investor is not required to be physically present in the country as it would be the case for other types of companies available here.

Accounting is required and the books shall be stored at the registered office in Labuan. Our clients often use a Labuan company to do business in Malaysia. 3 corporation tax on annual net profits.

Every transaction must be registered within 90 days after its completion. Upon successful completion of company registration depending on business activity and company profile company can apply 3 to 4 positions of foreign expats for Labuan work permit. A Labuan international company can be easily established if the main steps of the process are respected.

Labuan Company enjoys a corporate tax rate of 3 while a Labuan Investment Holding company completely 0 tax rate. To apply for work permit company needs to have a minimum paid-up capital of more than. Parents can be included in the applicant for a yearly visa.

Labuan Taxes are Easy. Trading with Labuan offshore company will give you a great deal for saving tax and efficiency. Incorporation of a Labuan company in Labuan IBFC must be done through a Labuan trust company.

By setting up a Labuan company as a foreigner you will be able to get 2 years Labuan work permit DP10 without any hassle. No sales tax VAT custom duties or stamp duties. Upon lodgement of complete documentation and payment of fees as well as clearance from the due diligence process conducted by Labuan FSA a Labuan company can be approved for incorporation or registration within 24 hours.

Register Labuan Company Form is for registration of Labuan Company with different types of capital structure and varies service options to choose from. Living across Johor provides you a big deal of tax efficiency and tax efficiency. Zero tax for companies conducting non-trading activities such as holding companies.

Also in this section. There is no goods and services tax GST or sales and services tax SST on sales transactions performed in Labuan. Company registration in Labuan Labuan has signed more than 40 agreements to avoid double tax payments including with France the Russian Federation Austria Australia the Netherlands and.

You also can start a marketing office in Iskandar to develop your business. Malaysia Double Taxation Agreement DTA protects your income from being taxed twice. It is important to list the nationalities of all Directors and Shareholders to ensure that background check is clear.

Labuan holding company is subject to 0 tax zero tax Labuan licensed company is subject to 3 tax. Fill in shipping company address or special request if any. You can commence the company registration even if you are still in your country of residence.

Clients enjoy several tax benefits with an offshore company registration in Labuan including. Choose your payment method We accept payment by CreditDebit Card PayPal or Wire Transfer. Our service package includes Labuan company formation tax planning opening Labuan or international corporate bank accounts Labuan visa and financial license application.

The application should be submitted together with the Memorandum and Articles of Association consent letter to act as director statutory declaration of compliance as well as payment of registration fees based on paid-up capital. In accordance with Labuan Financial Services Authority Labuan FSA it is mandatory for corporate entities partaking in businesses within the jurisdiction to file annual tax returns electronically by the last business day of March following the fiscal year ending on 31 st However businesses can request for an extension until the end of May subjected to approval. Audit is not required unless the Labuan Company chooses to be taxed at 3 of its net profits and only audited accounts have to be submitted to the Labuan authorities.

Tetra Consultants assist our international clients with Labaun company registration. Register or log in and fill in the company names and director shareholder s. Dependents of spouse and children aged under 21 can be included in the two 2 years work visa application.

Every Labuan company is obliged to comply with IRBs regulations to lodge Employer Return Form LE declaring the number of staffs employed in the Company and every employee has the duty to file their Personal Income Tax Form BE on a yearly basis. Please note that if they are from the High Risk Jurisdiction list there may be additional requirements for registering the company.

Labuan Corporation Formation And Benefits Of Offshore Companies

Labuan Company Formation Registration Cost Malaysia

Form Lfb Labuan Financial Business 2014

Labuan Company Formation Registration Cost Malaysia

Komentar

Posting Komentar