Examples Of Labuan Non Trading Company

Labuan FSA issues market guidance in order to facilitate applications of the various requirements of the Labuan entities. Only applicable for Labuan Entity that has no.

Labuans offshore companies are widely used for investment purposes in particular in China Korea and Indonesia.

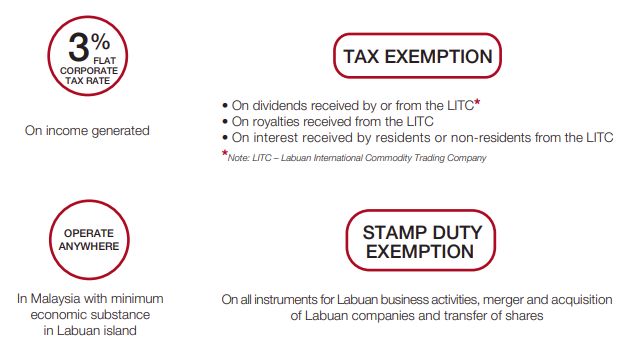

Examples of labuan non trading company. Incidentally the corporate tax rate is only 3 for the other companies. A Labuan offshore company that is non-trading is a business that is engaged in activities that are limited to owning stocks securities and properties in its own behalf. Withholding tax exemption on payments made to non-residents.

How to incorporate a Labuan company under LCA. In this sense the non-trading company is essentially a holding company based in Labuan. As a rule it is as follows.

Not subject to tax. Labuan entities that carry on a non-Labuan business activity are subject to the provisions of the Malaysian Income Tax Act 1967 ITA. The shareholders dividend is exempted from Tax.

Appointment of a Labuan trust company. 24 on IP and royalty income. Taxation of a Labuan Company.

No import duty sales tax capital gain tax. 24 if rental income is receivable. With effect from 1 January 2019 Labuan business activity means a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan excluding any activity which is an offence under any written law.

A Malaysia Labuan International Company obtains the following benefits. This revised definition means that a Labuan entity may. Trading companies pay only 3 corporate tax on their audited net profit up to a maximum tax of RM 20000 per year about 4700 USD.

Trust Companies are compulsory to submit 60 of their clients tax return regardless they are carrying on Labuan Trading business activity or Labuan non-trading business activity or dormant companies. Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf. - a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan - excluding any activity which is an offence under any written law.

Incorporation under the LCA. A Labuan company is formed either through. Means an activity relating to the holding of investments in securities stock shares loans deposits or any other properties situated in Labuan by a Labuan.

Lower or No Taxes. Labuan trading activity Includes banking insurance trading management shipping operations licensing or any other activity which is not a Labuan non-trading activity. It is possible to smoothly carry out meetings and business trips between Labuan and other countries For example.

It is also known as a good means for transnational investment from Europe to Asia. 0 for holding activities. LBATA 1990 ITA 1967.

In addition there is NO. It is possible to obtain work permit even for a non-trading company that is aimed at asset management like Business Consulting. The incorporation of a Labuan company would involve the following procedures.

Labuan business activity means. Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity. How is a Labuan company formed.

Labuan non-trading activity Holding of investments in securities stock shares loans deposits or any other properties situated in Labuan by a Labuan company. Holding of investments in securities stock loans etc. Therefore no income tax levied on foreigners.

Which is not a Labuan non-trading activity Labuan non-trading activity Holding of investments in securities stock shares loans deposits or any other properties held by a Labuan entity on its own behalf Same tax treatment as Labuan trading activity 3 of net profits per audited accounts or MYR20000 upon yearly election 3 of net profits per audited accounts. The offshore company registered in Labuan invests in a country with high taxation and with which the state has an agreement on avoidance of double taxation. Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf.

3 of net profits as per audited accountsor. In most cases this applies to those Labuan companies that are engaged in business with Malaysian companies also referred to as non-Labuan business activities. A Labuan non-trading company is a company which engages an activity relating to the holding of investments in securities stock shares loans deposits or any other properties by a Labuan entity on its own behalfits effectively a holding company.

3 on net profits. Trading company Non-trading company. One of our Labuan offshore company agents can give you more information about permanently opting to be taxed under this regime.

We can also provide complete information about a double tax treaty signed between Malaysia and. Or registration under the LCA of a foreign company in corporated outside Malaysia as a foreign Labuan company. Non-trading offshore companies are tax exempt.

Trade in any currency including the Malaysian Ringgit and. Among others these include detailed explaination or clarification of rules governing the business and conduct of Labuan entities. Offshore non-trading companies do not pay any taxes on income sourced outside of Malaysia.

Define Labuan non-trading activity. RM20000 USD5000 0 tax on Labuan Non-Trading activities Investment Activities Double Tax Agreements Treaties with over 70 countries. Companies which choose to pay the RM 20000 lump sum tax are not required to file audited reports.

Japan Hong Kong Singapore etc while having work permit in Malaysia. Banking insurance shipping or any other Labuan trading activities. Minimum tax on Labuan trading company upon election annually.

Labuan Company Formation Registration Cost Malaysia

Labuan Company Formation Business Incorporation Registration

A Guide To The Gift Programme Finance And Banking Malaysia

Labuan Company Formation Business Incorporation Registration

Malaysia Labuan Exsilium Co Ltd

Komentar

Posting Komentar