Benifits Of A Labuan Investment Holding Company

The other services of a trust company are providing the registered office and becoming the resident secretary. Incorporation of Labuan International Company can be 100 foreign-owned without local Malaysia partner.

Labuan Company Formation Registration Cost Malaysia

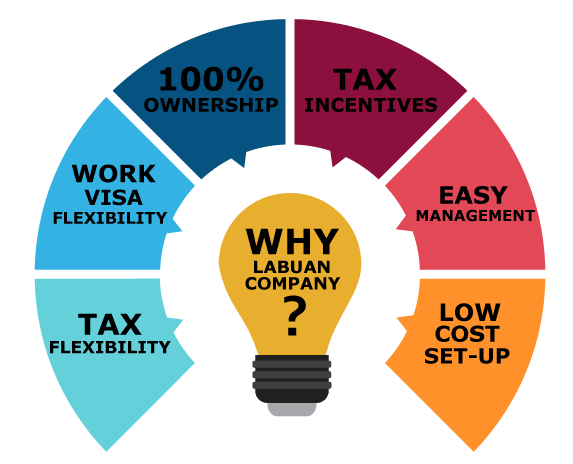

One of the Labuan jurisdictions key advantages is that it offers 100 foreign ownership and NO taxes.

Benifits of a labuan investment holding company. Our incorporation team can offer our client in-depth understanding on Labuan company advantages as well as details required to set up a Labuan company. 0 indirect tax such as Sales Tax Service Tax GST VAT and Custom Duty 0 Personal Income Tax on Director Fee for Non-Malaysian Director. Dividend Royalty Lease Rental Interest Technical or Management Fee.

Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf. The most attractive advantage of a Labuan investment holding company is the zero tax advantage and no audit reporting is required. The favourable investment and tax regime in Labuan IBFC coupled with Malaysias extensive DTA network and a modern approach to company law make the jurisdiction an attractive location to hold investments.

ADVANTAGES OF LABUAN OFFSHORE COMPANY 3 Corporate Tax. There are several ways in which Labuan can be used as an investment vehicle. Investment Holding of your other companies in your own country or Malaysian companies.

Besides that 1USD is the minimum share capital for opening an IBC in Labuan. Labuan Companies Act 1990 Removal of the requirement to obtain approval for dealings between Malaysian residents and Labuan companies. Double Taxation Agreement DTA with more than 70 Countries Labuan Company enjoys the benefits of more double taxation treaties than any other offshore company as it almost enjoys same full double taxation benefit as Malaysia company except for eleven 11 of those 74 countries and it can enjoy full treaty benefit even with those eleven 11 countries by incorporating a Malaysian.

Consequently the Labuan Investment Committee LIC which comprises representatives of the Ministry of Finance MOF Labuan Financial Services Authority LFSA and the Malaysian Inland Revenue Board MIRB was formed in 2019 to recommend policies on substantial activity requirements and monitor the enforcement of such. Advantages Registering Malaysia Labuan Company Here is some keys point of attraction. Investment holdings activities can be any combination of the followings.

An activity carried on by a Labuan entity that is not a Labuan business activity is taxable under the Income Tax Act 1967 ITA. Businessmen around the world incorporate Labuan company due to its tax competitive advantage which is just 3. In a rebranding exercise the name was changed to Labuan.

0 Stamp Duty Labuan is a free tax port. These Labuan Investment Holding Company Labuan IHC owners may hold access to. The paid-up capital of the Company can start as low as USD 1.

Investment holding and other offshore activities carried on by multinational companies. Investment Activities 0. In matters of taxation the 3 rate represents the flat fee imposed on the companys profits generated in Labuan.

Malaysian and foreigners are allowed to set up personal Investment Holding Company IHC by being the shareholder. It is a requirement under the Labuan Companies Act 1990 LCA that a Labuan company must employ the services of a Labuan Trust company to act as their Labuan company formation agent to incorporate and register the company under the LCA. Investors interested in company formation in Malaysia should know that the businesses registered in Labuan benefit from a more favorable taxation system applicable under the Labuan Business Activity Tax Act 1990.

Trading Activities 3 on Audited Net Profits. Having 100 foreign ownership is a solid benefit for entrepreneurs from abroad who decide for investments in Malaysia. Many of the BVIs advantages are common to numerous other jurisdictions English language absence of currency exchange controls US dollar as a currency stable democracy common law legal system with final appeal to the Privy Council in London a number of other advantages are not.

Its well-established banking and financial system modern communication and infrastructure make it an attractive location to establish a holding company. Investment companies usually only hold assets or shares. For entities carrying on a Labuan business activity income derived solely from the holding of investments by the entity on its own behalf ie Labuan non-trading income generally is exempt from tax under the LBATA.

The Labuan Holding Company further benefits from capital gains tax avoidance and double taxation avoidance treaties signed by the Malaysian government with other countries subjected to individual country treaty exclusions for Labuan corporate entities. It is also a highly reputable jurisdiction which is fully compliant with international standards. Labuan entities may access benefits under the Malaysia DTAs.

The legislature which governs offshore company formation in Labuan allows for a number of practical benefits of the jurisdiction such as its cost-effective and convenient incorporation laws favourable taxation and high level of confidentiality.

Labuan Private Trust Company Lower Your Wealth Management Cost

Set Up A Labuan Private Foundation Qx Trust Offshore Consultants

Eurasia Trust Ag Bonds Beyond Expectations

Http Cogentassets Com Foundations

Labuan Private Fund Registration

Komentar

Posting Komentar