How To Register A As Labuan Auditor

As our client you will benefit from the joint expertize of local lawyers and international consultants. Affordable Labuan incorporation cost which sums up to a Nominal Share Capital at USD 1.

Alternatively you can incorporate your company without traveling to Labuan.

How to register a as labuan auditor. Otherwise the Internal Audit Report must be submitted to Labuan FSA within three 3 months after the completion of the internal audit. If individual - Certified passport certified proof of address resume reference letter issued by professionals. There is a mandatory requirement to audit the books.

Director fee or dividend is non-taxable. You must prepare these documents and all required supporting information prior to submitting the electronic application. Call us now at 6018 7777 938 to set up an appointment with our business consultants in Labuan.

It is a legal entity with rights and status of a separate and independent person. Labuan Trading Companies have a yearly election of either paying a flat tax rate of MYR20000 per annum or 3 of audited net profit. There is a mandatory requirement to have a Resident Secretary.

Ensure the size of each email does not exceed 10Mb. The application should be submitted together with the Memorandum and Articles of Association consent letter to act as director statutory declaration of compliance as well as payment of registration fees based on paid-up capital. Labuan Non Trading Company.

No capital requirements as Labuan Private Foundation can start with only a minimum endowment of USD 100 as an initial asset at the time of the establishment. The IRB dateline to submit your corporate tax is 31st May of which you should send your accounts for audit latest in the month of March this would allow sufficient time for the auditor to complete their auditing of your accounting books to meet the 31st May dateline. Low tax rate at 3 of audited net profits or fixed tax of RM20000.

Submit Certified True Copy of all the relevant certificates as well as valid Practising Certificate. Among others these include detailed explaination or clarification of rules governing the business and conduct of Labuan entities. Labuan FSA issues market guidance in order to facilitate applications of the various requirements of the Labuan entities.

Maintain a Registered Office in Labuan which can be the Trust Companys office. As our client you will benefit from the joint expertize of local lawyers and international consultants. Incorporation of a Labuan company in Labuan IBFC must be done through a Labuan trust company.

It is a requirement under the Labuan Companies Act 1990 LCA that a Labuan company must employ the services of a Labuan Trust company to act as their Labuan company formation agent to incorporate and register the company under the LCA. Trust Companies and Ancillary Services. List of Approved Auditors.

Scan and send a copy of your signed application and all required supporting documents to AuditorRegistrationasicgovau. Alternatively you can incorporate your company without traveling to Labuan. Also in this section.

Call us now at 6018 7777 938 to set up an appointment with our business consultants in Labuan. Labuan Legislation The law is stable and will remain unchanged for many years. Labuan Company Auditing Process is a step by step guide to assist you in getting the process time for your tax filing.

Declaration and tax payment must be done by the end of March the following year. A trading company which pays 3 of audited net profits is required to appoint an auditor and file audited financial statements. The other services of a trust company are providing the registered office and becoming the resident secretary.

Minimum Requirement 1 same director 1 same shareholder. Voluntary Winding Up Under Section 131A of the Labuan Companies Act 1990 or more frequently known as Liquidation This is the best and preferred method to dissolve a Labuan Company. There are two ways on how to dissolve a Labuan company.

Internal auditors should also report to Labuan FSA immediately any significant audit finding uncovered in the course of audit that would adversely affect the Labuan insurers operating and financial condition. Accounting audits are conducted by the auditor authorized by Labuan Financial Service Authority LFSA. If corporate - Certified proof of incorporation shareholding directorship license approval if any documents related to each individual as above.

Relevant document templates are accessible on the Tips for applying for auditor registration. In addition since the registration address of Labuan company is stipulated to be located in the office of Labuan Trust Company the registration address of the. Labuan financial services industry and to process applications to conduct business in the Labuan IBFC specifically in Labuan banking insurance and insurance related business trust and fund management incorporating and registration of Labuan companies as well as for the setting up of Labuan.

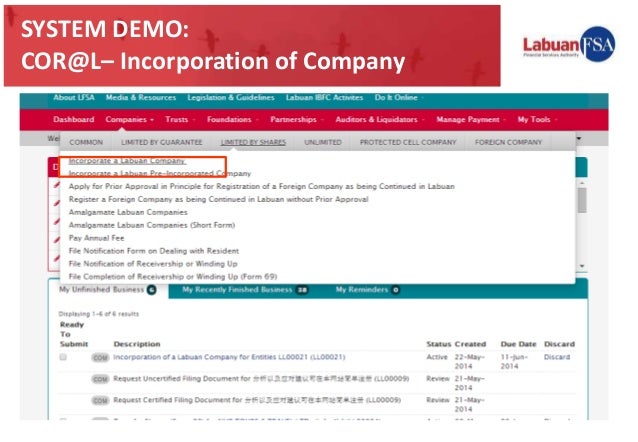

Proceed to submit the application for audit approval through BLESS. Register as an individual in Business Licensing Electronic Support System BLESS through httpwwwblessgovmybless. The companies in Labuan should have a Local Registered Office Address.

However it is the most expensive amongst the two methods.

Labuan Companies Faqs Labuan Ibfc

Labuan Private Fund Registration

Labuan Tax And Company Registration Low Tax Country Near Singapore

Labuan Public Fund And Private Difference Labuan Company Formation Labuan Work Permit Labuan Taxation

Labuan Company Auditing Process

Komentar

Posting Komentar