Audit Companies Approved By Labuan Fsa

The meetings can be conducted at more frequent intervals should there be a need. The amount is 5000 RMN or 1500 USD.

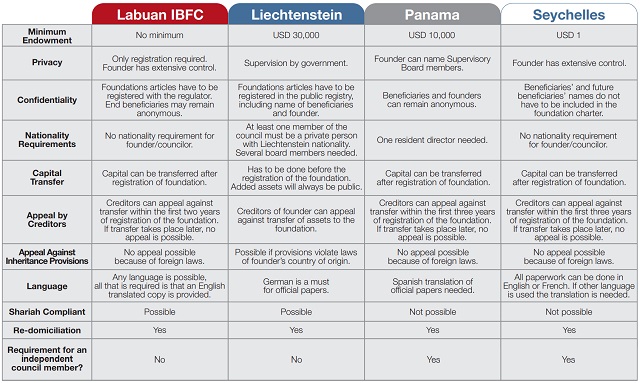

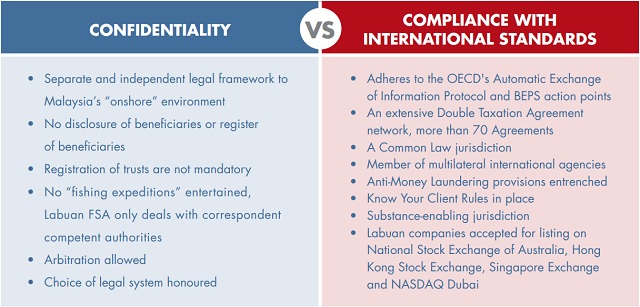

A Guide To Private Foundations For Wealth Management Wealth Management Malaysia

Extension of Time for Adoption and Submission of Audited Financial Statements pursuant to Section 111 of the Labuan Companies Act 1990.

Audit companies approved by labuan fsa. Among others these include detailed explaination or clarification of rules governing the business and conduct of Labuan entities. Perniagaan Pengendalian Pelancongan Dalam Negeri Inbound. External Audit 106 Employees of Labuan FSA 107 Integrity 107.

To this equal numbers of guidelines rules and circulars had been passed amended and removed. If the fund is managed by a non-Labuan licensed fund manager at least one of the service providers must be approved by Labuan FSA. The company needs to appoint an approved auditor and submit the annual account audit-Notify any changes.

Auditor will submit to us a copy of the audit report along with the relevant tax documents to submit to the Labuan Inland Revenue Board and Labuan FSA. For sale transactions to Malaysia the corporate tax will be 24 on net profit payable to the local Inland. Below are the list of almost if not all guidelines on doing business in Labuan arranged based on category of industries.

32 A Director must attend at least half 50 of the Board meetings held in the financial year. Labuan Companys corporate tax is 3 for international sales. By Labuan FSA a Labuan company can be approved for incorporation or registration within 24 hours.

Labuan FSA issues market guidance in order to facilitate applications of the various requirements of the Labuan entities. For a complete and latest updated guidelines in Labuan IBFC kindly refer here. The applicant should meet the pre-requisite of three 3 years relevant experience or audited accounts of the company.

Please allow 30 to 60 days for the auditor to complete the auditing process. Labuan companies as well as for the setting up of Labuan trust companies. Must appoint a fund manager trustee administrator and custodian that has been approved by Labuan FSA they must be independent of each other.

US385000 to include registered address co secretary annual. Or c in the case of a licensee who is either an individual or does not have an internal auditor by an auditor who shall not be the same auditor appointed for the purpose of section 173. 31 The Board shall meet at least four 4 times a year on quarterly basis with 2 meetings to be held in Labuan.

Company or any corporation which is related to the licensee. As part of the COVID-19 relief measurements and to ease the burden during this trying time please be informed that Labuan FSA. Provide guidance on license application work permit bookkeeping accounting.

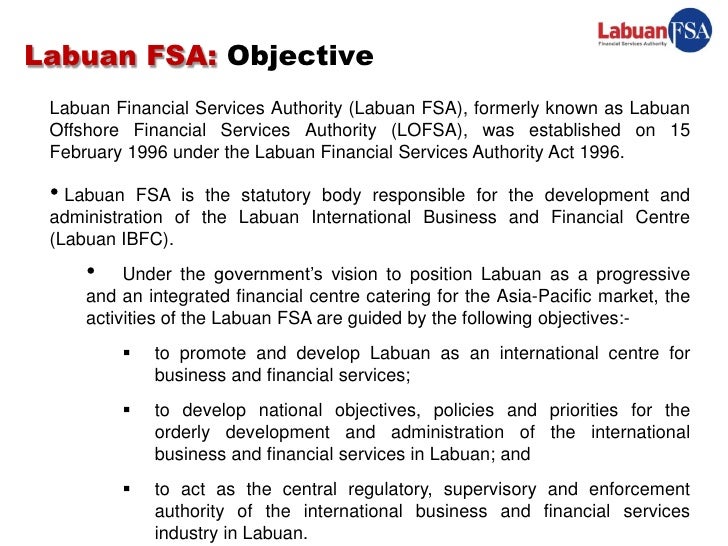

The Labuan Financial Services Authority Labuan FSA formerly known as Labuan Offshore Financial Services Authority LOFSA is an agency established on 15 February. To start the audit process we can help you to appoint an auditor from the list of Labuan approved auditors. Since its inception in 1990 many laws on Labuan had been passed amended and repealed.

A license holder is required to pay an annual fee for this license. 4 LABUAN FINANCIAL SERVICES AUTHORITY CHAIRMANS STATEMENT The year 2017 witnessed the. GST Licensed Agent under Seksyen 170 Akta Cukai Barang Dan Perkhidmatan.

The audited account shall be used for tax filing to the Labuan Inland Revenue Board. B by a qualified Labuan insurance manager as may be approved by Labuan FSA. Unit B Lot 49 First Floor Block.

Administrative Penalties under Section 36G of Labuan Financial Services Authority Act 1996 LFSAA Labuan FSA Email dated 3 January 2012 New Income Tax Exemption Orders for Labuan IBFC. Trust Labuan Tax Inc is a Labuan licensed trust company. 8 rows Min Year 2.

1312012ALL 27 April 2012 Clarification Note on Section 28B1 of the Labuan Financial Services Authority Act 1996. The annual fee is. Labuan FSA took note the difficulties faced by Labuan companies regarding the timely submission of audited financial statements in CORL system due to the impact of COVID-19 pandemic and other operational issues.

All Labuan Company with trading activities would require to have their accounts to be audited whether the sales activities are from Malaysia or international. The Labuan FSA is to be notified of any changes regarding the place of business ownership or shareholding. Dear SirMadam We wish to inform you that pursuant to Section 10 5 of the Labuan Companies Act 1990 LCA Labuan approved auditors are statutorily required to pay their annual fees.

A Labuan insurance broker is prohibited from dealing with residents except for high-net-worth individuals reinsurance and others as defined by Labuan FSA from time to time and broker for direct Malaysian risks. Approved by the Labuan FSA from 2013 to carry on corporate services business. To administer and enforce the Labuan financial services legislation.

Labuan FSA Letter dated 6. List of Approved Auditors. Approved Company Secretary under Companies Act 2016.

Co-Operative Auditor licensed by Suruhanjaya Koperasi Malaysia. Appoint an approved auditor to carry out an annual audit of its accounts in respect of its business operations pursuant to Section 174 of the LFSSA and Section 135 of the LIFSSA. All Labuan Approved Auditors.

Labuan Companies Auditor by Labuan Financial Services Authority under Labuan Companies Act 1990. Conduct its business in any foreign currency other than Malaysian Ringgit unless permitted under Section 74 of the Labuan Companies Act 1990. Regulatory and Operational Requirements for Labuan Public Fund.

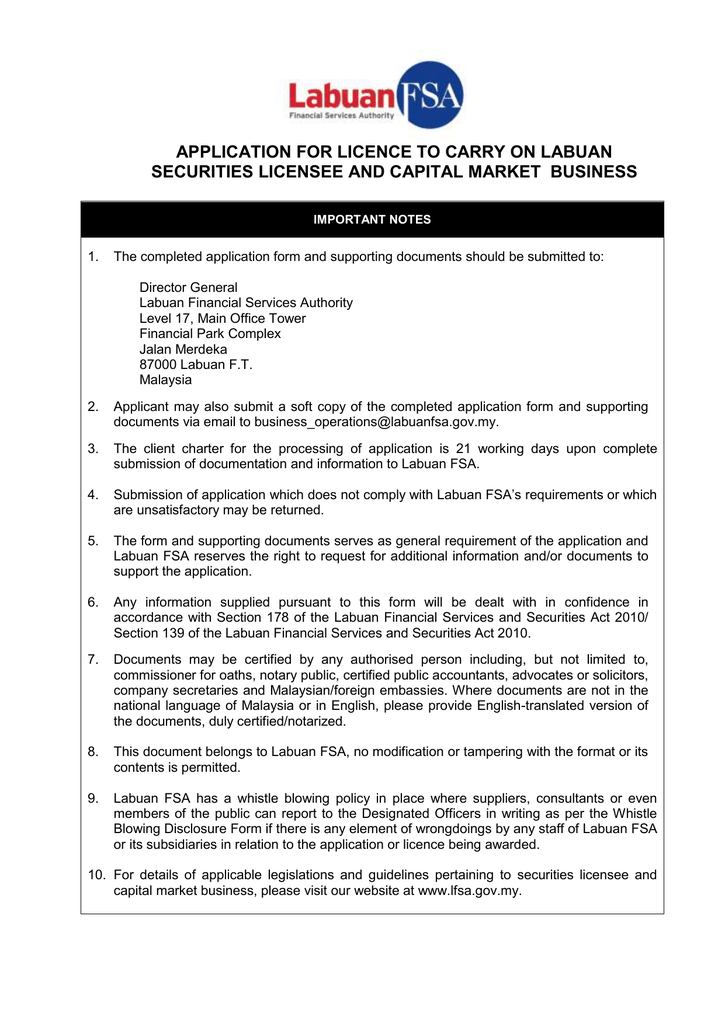

Form Lscm Labuan Securities Licensee Capital

Announcements Labuan Fsa Page 3

The Regulator About Labuan Ibfc Labuan Ibfc

Labuan Approves 46 Digital Financial Services Companies In H1 2020

Komentar

Posting Komentar