Labuan Lhdn Income Tax Department

The Department of Inland Revenue Malaysia became a board on March 1 1996 and is now formally known as IRBM. The agency is responsible for the overall administration of direct taxes under the following Acts.

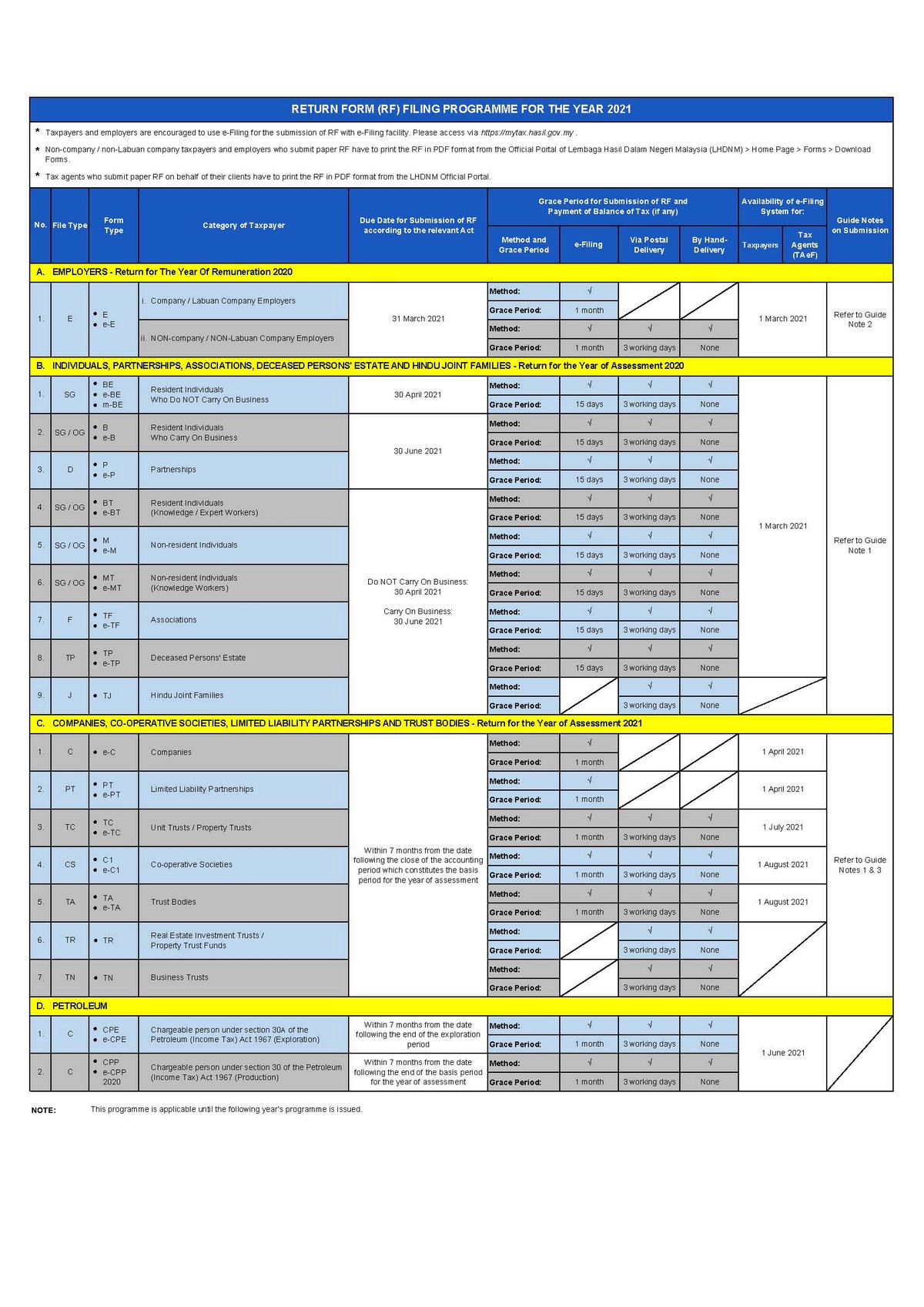

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

20182019 Malaysian Tax Booklet Income Tax.

Labuan lhdn income tax department. Failure to furnish the payment details will result in failure to update the taxpayers ledger. Is subject to tax under the Labuan Business Activity Tax Act 1990 instead of the Income Tax Act 1967. Many foreigners prefer to register Labuan Company to eligible to enjoy 100 foreign ownership and the other attraction is the flexible tax declaration.

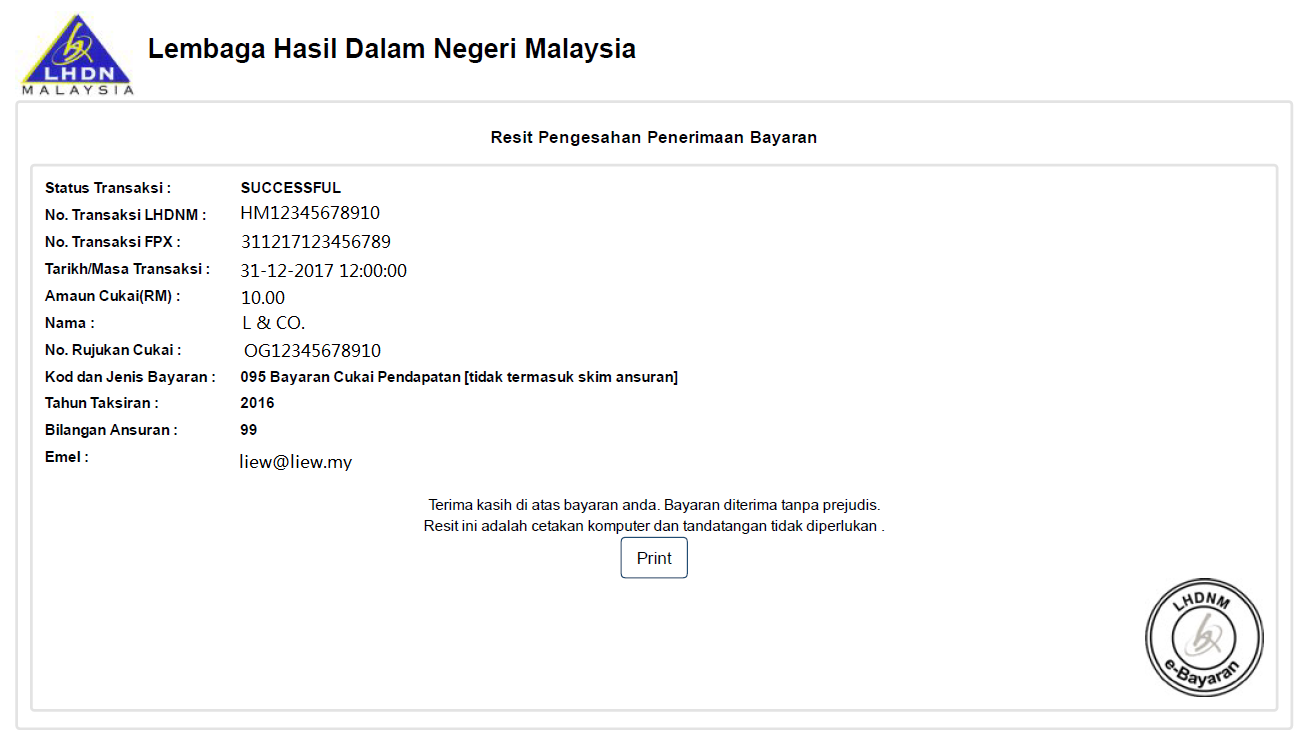

LHDN Petaling Jaya Branch. However the taxpayer will need to submit the payment details to the IRB via fax 036201 9637 or e-mail HelpTTpaymenthasilgovmy. Promotion of Investments Act 1986.

Jabatan Ukur dan Pemetaan Wilayah Persekutuan Labuan abbreviated JUPEM WP. Taxpayers individual or company whose tax files are being handled by Labuan BranchThe COR application should be send to the Labuan Branch at the following addressInland Revenue Board of Malaysia Labuan Branch Unit E004 dan E005 1st Floor Aras Podium Kompleks Ujana Kewangan Jalan Merdeka 87000 W. The new and intuitive official website of Income Tax Department which deals with e-Filing of returnsforms and other related functionalities.

Labuan is also known as the Department of Survey and Mapping Federal Territory of Labuan in English. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia. Tax payments exceeding RM1 million can be remitted via Telegraphic Transfer TT.

Monday - Friday. The Labuan Income Tax Office LHDN Labuan is one of the main revenue collecting agencies of the Ministry of Finance. Tax agents who submit paper RF on behalf of their clients have to print the RF in PDF format from the LHDNM Official Portal.

This document replaces the 2003 Transfer Pricing Guidelines. Copy of the notice of registration of the conversion to LLP under section 32 of the Limited Liability Partnership Act. Hasil Tower PJ Trade Centre No 8 Jalan PJU 88A Bandar Damansara Perdana 47820 Petaling Jaya Selangor.

730 am - 530 pm. Prepared by the IRBM Multinational Tax Department the Guidelines are intended to help explain administrative requirements pertaining to Section 140A of the Income Tax Act 1967 and the Income Tax Transfer Pricing Rules 2012. 150 Tarikh Kemaskini.

Particulars Of Change Or Alteration Relating To Foreign Company under subsection 567 1 Companies Act 2016. We support Singapores sustainable economic growth by fostering a competitive tax environment and administering Government schemes. 03 - 9207 4200 Fax.

087 - 415 385. E-Filing Home Page Income Tax Department Government of India. 087 - 595 300.

800am - 1215pm 245pm - 500pm. A taxpayer who is convicted of an offence is liable to a. 03 - 7882 7500.

A Labuan entity can make an irrevocable election to be taxed under the Income Tax Act 1967 in respect of its Labuan business activity. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Income Tax Act 1967.

The LHDN Labuan also to act as agent of the Government and to provide services in. 800am - 100pm 200pm - 500pm. Rejection of TDS returns due to FVU version Mismatch.

All business owners of Labuan International Company must perform regular compliance for the companies they own to avoid any future complications and penalty. Petroleum Income Tax Act 1967. Taxation for Labuan International Company Tax Rate and Compliance.

Malaysia IRBM such as Real Property Gains Tax Act 1976 Petroleum Income Tax Act 1967 Promotion of Investments Act 1986 Stamp Act 1949 and Labuan Business Activity Tax Act 1990. 12 One of the methods of enforcement carried out by IRBM is tax investigation. 03 - 9287 5466 Office Hours.

We are a partner of the community in nation-building and inclusive growth. LHDN Cheras Branch PGRM Level 8-12 Menara PGRM 8 Jalan Pudu Ulu Cheras 56100 Kuala Lumpur. Mon - Thu.

All enquiries may be directed to lhdn_jcmhasilgovmy. Non-company non-Labuan company taxpayers and employers who submit paper RF have to print the RF in PDF format from the Official Portal of Lembaga Hasil Dalam Negeri Malaysia LHDNM Home Page Forms Download Forms. The Inland Revenue Authority of Singapore IRAS is the largest revenue agency in Singapore responsible for the administration of taxes.

Real Property Gains Tax Act 1976. Copy of the partnership business registration certificate issued by the Companies Commission of Malaysia SSM 5. The LHDN Jalan Duta also to act as agent of the Government and to provide services in administering assessing collecting and enforcing payment of income tax petroleum income tax real property gains tax estate duty stamp duties and such other taxes as.

Income Tax is a tax on a persons income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 Tax Code as amended less the deductions if any authorized for such types of income by the Tax Code as amended or other special laws.

Everything You Need To Know About Running Payroll In Malaysia

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Http Www Hasil Gov My Pdf Pdfam Samplerf Guidebook C2019 2 Pdf

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Komentar

Posting Komentar