Personal Income Tax In Labuan For Malaysian Worker

Foreign sourced income received in Malaysia by resident individuals are tax-exempt. Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020.

Malaysia Payroll And Tax Guide Activpayroll

Trust Companies are compulsory to submit 60 of their clients tax return regardless they are carrying on Labuan Trading business activity or Labuan non-trading business activity or dormant companies.

Personal income tax in labuan for malaysian worker. Valuations of some types of employment income are as follows. Non-Resident Tax rate Uniform 30 3. We setup Labuan Company bank account work permit dependent pass.

We are a trust company based in Labuan Malaysia. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions. Benefits of Labuan Company.

Progressive taxation on annual salary income. Personal income tax - Foreigner. Expatriates may benefit from a special tax regime exemption on their income if the following two conditions are verified.

Other income is taxed at a rate of 30. Key points of Malaysias income tax for individuals include. Malaysia adopts a territorial approach to income tax.

The Labuan Financial Services Authority Labuan FSA formerly known as Labuan Offshore Financial Services Authority LOFSA is an agency established on 15 February. Resident stays in Malaysia for more than 182 days in a calendar year. Individuals Individual residents in Labuan with income accruing in or derived from Malaysia are subject to tax.

Cash remuneration allowances and perquisites. As long as your Malaysian counterpart willing to accept the non-deductibility as mentioned above Labuan company is entitled to the tax rate according to the latest Labuan Tax 2019 law. Youll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents.

The rate of tax ranges from 0 to 28 for resident individuals and a flat rate of 28 for non-resident individuals. In such instances tax residents will be exempted from paying personal income tax in Malaysia. 5 Steps to make the monthly payment for tax contribution for salary is as follows.

A visit to the Immigration Department in Labuan is essential after you receive the approval for the issue of work permit visa. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer. Register Labuan Company for Employer File E number with the Inland Revenue Board IRB Determine if the employee foreign director expatriates locals has the monthly income more than RM2850 threshold for.

Only applicable for Labuan Entity that has no tax outstanding including compound and tax increment. Your employment income is taxed at 15 or progressive resident rates whichever results in a higher tax amount. Foreigners employed in Malaysia must give notice of their chargeability to the Non-Resident Branch or nearest LHDN branch within 2 months of their arrival in Malaysia.

For the most part foreigners working in Malaysia are divided into two categories. Therefore whether you are a Malaysian or a foreign national as long as you reside in Malaysia for less than 182 years in a year any income you earn in Malaysia is taxable under non-resident income tax rates. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

Yes any foreigners who have been working in Malaysia for more than 182 days are eligible to be taxed under normal Malaysian income tax laws and rates just like Malaysian nationals. Labuan work permit holder and Malaysian Non Tax Resident submit Form M. Gains or profits from an employment includes the following.

Alternatively you may also opt to pay a 24 tax rate dealing with Malaysian companies. However if the company has failed to obtain one the worker can register for an income tax number at the nearest IRB office. You are not entitled to tax reliefs.

Therefore an employees income in respect of the employment in Malaysia will be subject to Malaysian tax regardless of whether it is paid in Malaysia or outside Malaysia. More than 182 days in Malaysia Ref. Nonresidents are subject to withholding taxes on certain types of income.

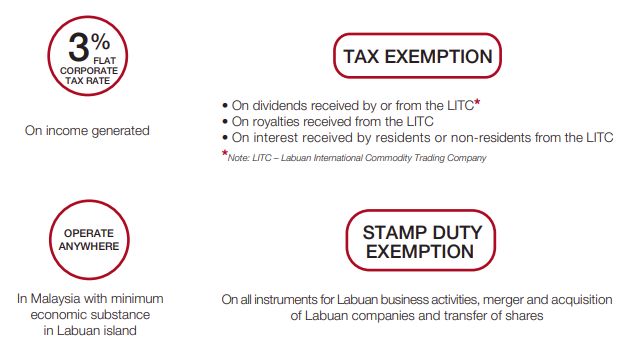

Personal Income Director Fee to attend board meeting is tax free Dividend to shareholder is also zero income tax 5. Inland Revenue Board Of Malaysia. Your Labuan Company will pay zero corporate tax 4.

Labuan Legislation The law is stable and will remain robust for many years 6. Directors fees and other income are taxed at the prevailing rate of 22 20 prior to Year of Assessment 2017. Residents and non-residents are subject to tax on Malaysian-source income only.

Less than 182 days in Malaysia Ref. Double Taxation Agreements DTAs You are protected in avoidance of double taxation 7. The applicant will be required to pay a fee of MYR 1225 Malaysia visa- MYR 500 and Malaysia Pass- MYR 725 at Labuan Immigration in order to receive the work permit.

No Labuan work permit holder and Malaysian Tax Resident NA.

Covid 19 The Enhanced Wage Subsidy Programme Bdo

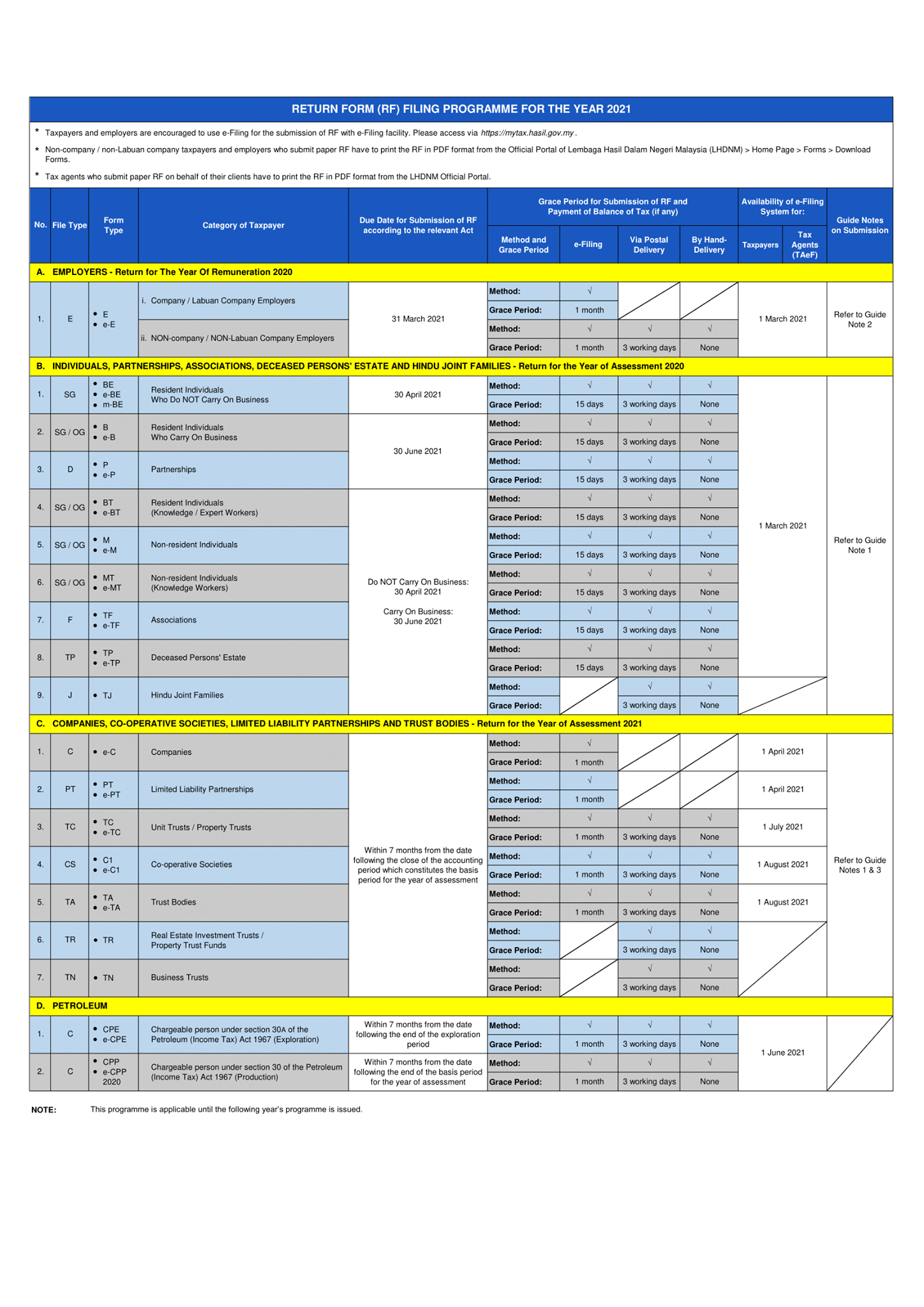

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

A Guide To The Gift Programme Finance And Banking Malaysia

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Corporate Tax In Malaysia Malaysia Taxation

Komentar

Posting Komentar