Dividend Received From Labuan Company

Dividends received by Labuan Company have no tax. Dividend income received by the holding company from the subsidiary must either be exempted from or subject to low corporate income tax rates in the holding companys jurisdiction.

Tax Incentives For Labuan Company Corporate Services Trust Co Ltd

Non Pure Equity Holding.

Dividend received from labuan company. The members are collectively when applicable the owners of the company. Dividends received from Labuan entities. Minimum spending in Labuan.

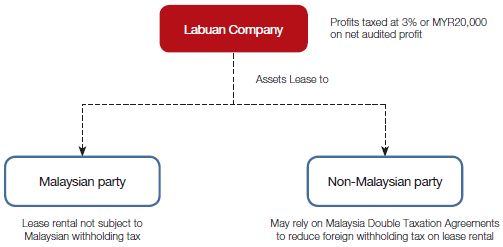

Interest royalties lease rental technical fee and management fees paid to a non-resident are not subject to withholding tax. A typical holding company structure using a Labuan entity and its corresponding tax profile is shown. - Dividends received from Labuan entities - Distributions received from Labuan trusts and foundations conventional or Islamic by the beneficiaries - Distribution of profits by Labuan partnerships conventional or Islamic partnerships - Interest received by residents non-residents or another Labuan entity from a Labuan entity.

Dividends received from Labuan entities. Dividends received from Labuan offshore companies 20000 Dividends received from overseas companies 5000 Interest non-exempt 10000 Rent 70000 Gains on realisation of investments 75000 500000 Less. However the Finance Act 2020 changed the method of dividend.

Dividends received from Labuan companies that carry out trading activities is not subject to tax. Moreover all management fees payable to Labuan Investment Holding Company attracts no withholding tax. Distributions of profits by Labuan partnerships.

0 on Withholding Tax There is no withholding tax on dividends paid by a Labuan Company in respect of dividends distributed out of income derived from Labuan business activities or income exempt from income tax. Dividend income received. Currently the new set up for pure equity holding company dont require any staff in Labuan but require a minimum annual spending of RM 20000.

Distributions received from Labuan trusts and foundations including both Islamic by the beneficiaries. Capital Gains For Labuan entities carrying on Labuan trading activity and both Labuan trading and non-trading activities. That was because the company declaring such dividend already paid dividend distribution tax DDT before making payment.

Labuan is a jurisdiction in which only one shareholder is required to open a company and foreigners have the same rights as. The shareholders of a company in Labuan are those individuals or other legal entities that own one or more shares in public or private companies. Dividends are included in those types of profits and income along with interest royalties income from rents and commissions for which repatriation is permitted without any hindering rules.

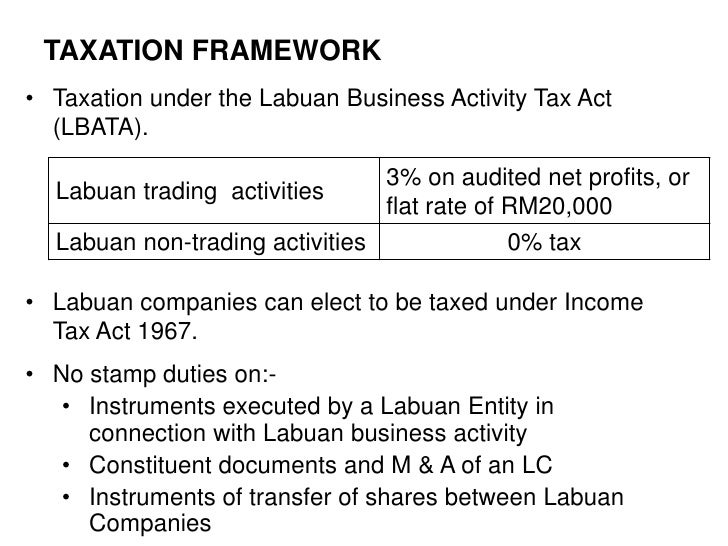

Must have central management and control in Labuan. The regulations are unclear on whether non-trading income such as dividends received by an investment holding company in Labuan from a foreign subsidiary is exempt from tax or would be taxed at 24 under the LBATA if the Labuan entity fails to meet the substance requirements for a YA. Labuan investment holding - Hold investment that has passive income.

A Dividends received from an offshore company which are paid credited or distributed out of income derived from an offshore business activity or income exempt from tax. 50 of gross housing allowance and gross Labuan Territory allowance received. Distributions received from Labuan trusts and foundations by the beneficiaries.

Dividend received from an Indian company was exempt until 31 March 2020 FY 2019-20. Labuan investment holding - Hold shares of subsidiary company. Receive capital gains as income.

Payments of dividends interest service fees and royalties by the Labuan company to non-residents are also exempt from Malaysian withholding tax. Interest on loan to buy shares 50000. Pure Equity Holding Labuan Company hold equity participation and earn receive interest from dividend monies or capital gain proceeds from disposal of shares the corporate tax rate of 3 on net profits may be enjoyed provided that 1 control and management is established in Labuan and 2 a minimum annual operating expenditure OPEX of RM 20000 is spent in Labuan.

Receive dividend from a subsidiary company. B Distributions received from an offshore trust by the beneficiaries. Distributions of profits by Labuan partnerships including Islamic partnerships Interest received by residents non-residents or another Labuan entity from a Labuan.

As far as exchange control is concerned the repatriation of capital is subject to relaxed rules in Malaysia. Received housing allowance and Labuan Territory allowance from exercising an employment in Labuan with a Labuan entity.

Presentation Labuan International Banking Tax Perspectives

Leasing A Guide To Leasing In Labuan Real Estate And Construction Malaysia

![]()

Labuan Tax Changes In Substance Requirements Zico Law

Leasing A Guide To Leasing In Labuan Real Estate And Construction Malaysia

Presentation Labuan International Banking Tax Perspectives

Komentar

Posting Komentar