Can Labuan Trading Company Purchase From Malaysia

Offshore companies in Labuan can. Can be used to in the local business in Malaysia for example consulting manufacturing restaurant travel agency telecommunication etc.

Ownership of Malaysia Sdn Bhd Company Malaysia Private Limited Company.

Can labuan trading company purchase from malaysia. Ownership of a Labuan International Company LIC Individual name and. Subject to corporate tax rate of 20 on the first MYR500000 and thereafter 24. If annual revenue for Malaysia dealings is more than RM 500000 6 GST is applicable.

Minimum tax on Labuan trading company upon election annually. - Under Section 3A1 of the LBATA 1990 a company can elect to be taxed under the Malaysia Income Tax Act 1967 ie. 03 How to apply and what are the conditions for licence under the GIFT programme.

A Labuan Offshore Company may not. Labuan Investment Holding Company can be public listed in major stock exchanges such as Malaysia Singapore Hong Kong Australia and Dubai. Using the offshore company to purchase real estate property to enjoy tax benefit protect the asset and minimize probate.

It is also deemed as the perfect vehicle for Initial Public Offering IPO or Reverse Take-Over RTO within the same entity in other jurisdictions which is more time and cost effective. A shelf company in Labuan is a ready-made company with no activities and which addresses to both local and foreign investors who want to enter the Malaysian business market in a fast mannerThe characteristics of shelf companies in Labuan often stand at the base of the decision of purchasing such business structure instead of forming a new one from scratch. Labuan is a jurisdiction suited for offshore companies because of the low taxation regime the easy Labuan offshore company set up process and the fact that foreigners can easily own 100 of the company and open bank accounts.

Know the complete advantages and find out more the comparison of investment holding between Labuan International. A resident of Malaysia holds shares in that Labuan company. Offshore Company Registration Company with preferential Tax treatment Firm or Business registration.

Under the programme a set of incentives are offered through the establishment of the Labuan international commodity trading company LITC including incentives for traders and trading houses to use Malaysia as their international trading base. Although a Labuan company cannot engage solely in trading with Malaysian companies it can deal with local companies to. A Labuan company can be incorporation in Labuan IBFC but it must be done via a Labuan.

1 Section 3A states that a Labuan entity carrying on a Labuan business activity may make an irrevocable election in the prescribed form so that any. Off-shore Company Registration in Labuan Offshore Non Trading. 3 of net profits as per audited accountsor.

Collection and preparation of all necessary documentation to register Company. A Do business with a resident of Malaysia except as permitted by the Offshore Banking Act 1990. Labuan international commodity trading companies used Malaysia as their international trading base to undertake international commodity trading business in Labuan IBFC.

A Labuan Offshore Company should only carry on business in from or through Labuan. If all your paperwork is in order it can be done in as quickly as a week. Friendly and hospitable Malaysia has successfully attracted many foreign to venture into the trading business into the country over the years.

At present property investment in Malaysia can be done through three primary means. A Labuan trading company is a company established in Labuan Malaysia that carries on certain Labuan trading or non-trading activities. Except the above other transactions would require reporting to Labuan FSA for such activities within 10 working days from the date of contract or invoice of non-Ringgit transactions including the acquisition of Malaysia real estates with Sales and Purchase Agreement.

Labuan entities can invest in domestic companies while enjoying the tax exemptions accorded in Labuan IBFC. By foreign corporation only. Labuan Jurisdiction is a midshore hence all Labuan companies are allowed to deal with Malaysians with 3 corporate tax.

Labuan entities may access benefits under the Malaysia DTAs. I conduct business with both Malaysian resident and non-resident companies ii conduct shipping operations to anywhere including Malaysia iii transact in any currency and iv offer products and services in non-regulated industries. Can be 100 foreign owned subsidiary.

What business can be conducted. By foreign corporation only. The ease of registering a business.

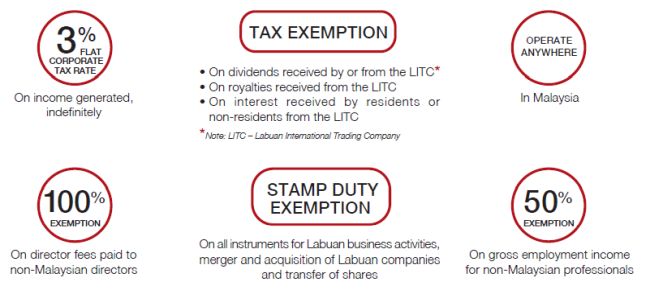

Labuan companies enjoy tax advantages with a tax rate of 3 on audited net profits for companies that carry out trading activities and 0 for companies that carry out non-trading activities. The Global Incentives for Trading GIFT programme is aimed at positioning Malaysia as a regional trading and storage hub for oil and gas. KEY ADVANTAGES OF A LABUAN TRADING COMPANY.

Fast secure and confidential. Corporate tax 3 on audited net profits for International dealings. All types of businesses operate under Labuan International Company can be owned 100 by foreigners.

Among the benefits to registering a trading company in Malaysia are. Corporate tax 24 on audited net profits for Malaysia dealings. No withholding tax on interest dividends management fees and royalty.

09 What is the difference between trading and investment companies.

A Guide To The Gift Programme Finance And Banking Malaysia

Benefits Of Offshore Company Registration In Labuan Malaysia Doing Business International

The Malaysia International Ship Registry And Shippin

Offshore Company Guide In Malaysia Business Setup Worldwide

Komentar

Posting Komentar