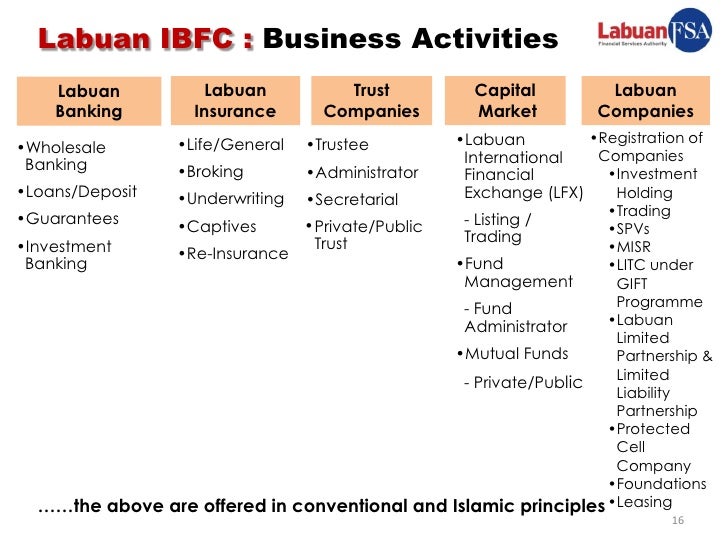

Business Activities In Labuan Ibfc

The Labuan legislations have put in place relevant legal measures to protect the confidentiality of businesses and individuals that allow them the protection and security of their businesses. How to establish a Labuan company in Labuan IBFC.

The Midshore Jurisdiction About Labuan Ibfc Labuan Ibfc

Labuan International Business and Financial Centre IBFC is a special economic zone of the Malaysian government based on the island of Labuan off the Borneo coast.

Business activities in labuan ibfc. The following business activities require prior approval from the Authority which we may assist you with its application. What is the rate of tax imposed on Labuan business activity. What is the definition of Labuan business activities.

30 Permitted business activities 31 A Labuan Captive Insurer may underwrite direct insurance reinsurance general or life business risks- a of their own Group. For Labuan money broker that undertakes Islamic money broking business is required to appoint a qualified person to its internal Shariah advisory board to ensure that its management and operation are in compliance with Shariah principles. Labuan Business Activity Tax Act 1990 LBATA Under the LBATA a Labuan entity carrying on a Labuan trading activity is charged tax at a rate of 3 on the net audited profits reflected in the audited accounts of the Labuan entity for each year of assessment.

All dealings must be done through this registered office in Labuan. It was established in 1990 and has been marketed as having a unique position to tap investment opportunities in Asia and beyond. The revised framework contains the following.

Company management business in Labuan IBFC provides treasury processing services and such other services and to such persons as maybe permitted by Labuan FSA. IFS is introduced by Labuan International Business and Financial Centre Labuan IBFC to adapt to the current technological trends of which AI is the most revolutionary. Business transactions of Labuan companies must be made in currencies other than the Malaysian Ringgit except for the purpose of defraying administrative and statutory expenses as well as receiving.

The activities of the Labuan insurance-related business are governed by the Labuan Financial Services and Securities Act 2010. Labuan IBFC respects and protects the right to confidentiality for each business and person. In this regard the Directive on Islamic Financial Business in Labuan IBFC shall also be observed.

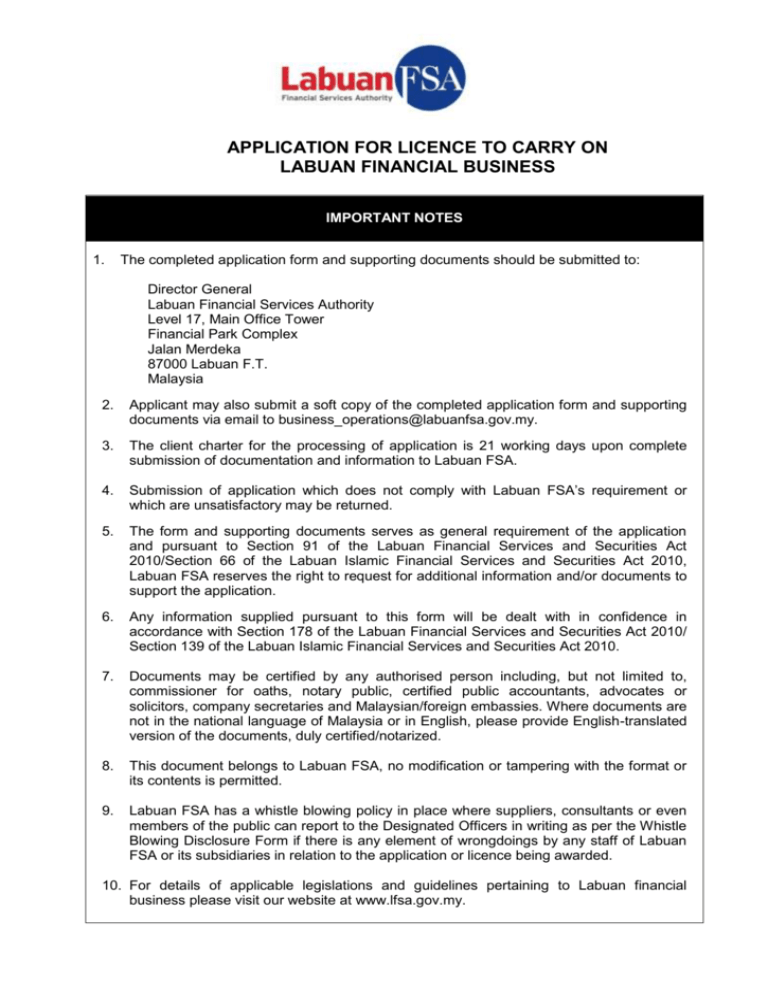

The applicant company can only transact business in foreign currency and not deal in Malaysian Ringgit except for the purpose of. Licence Application for Regulated Business Activities in Labuan IBFC. What is the definition of Labuan of trading and non-trading activities.

Can a Labuan company elect to. LABUAN IBFC TAXATION SYSTEM Labuan Business Activity Tax Act 1990 LBATA governs the imposition assessment and collection of tax on a Labuan business activity carried on in from or through Labuan. As a Labuan Fund Manager he or she provides investment advice or directly manages the funds for investments or trading within a company.

Insurance business in Labuan IBFC. The applicant company must maintain a registered office in Labuan. Section 75 of the Labuan Companies Act 1990 LCA allows a Labuan company to deal with a resident subject to the filing of notification to Labuan FSA within 10 working days of the transaction.

A dedicated unit to market and promote Labuan IBFC was set up followed since then by the legislative changes. Labuan FSA issues market guidance in order to facilitate applications of the various requirements of the Labuan entities. 32 A Labuan Captive Insurer may obtain reinsurance coverage from any.

Labuan Insurance Broker A Labuan insurance broker is defined as a person who is licensed to arrange Labuan insurance business on behalf of prospective or existing policy owners and arrange Labuan reinsurance business on behalf of any insurer seeking reinsurance. The IBFC introduced a new tax framework also known as the Labuan Business Activity Tax Act 1990 LBATA in 2019 to address elements of harmful tax practices that hindered the competitiveness of Labuan IBFC. Banking Leasing Money Broking Fund Management Security Licence Insurance Insurance Related Factoring International Commodity Trading.

The diverse selection of Labuan IBFCs financial products and services brings to investors a wealth of business opportunities covering the areas of banking insurance trust company business capital market wealth management and other Labuan financial businesses. In line with this objective Labuan IBFC identified five key areas of focus namely holding companies Islamic finance insurance including captive insurance private wealth management and fund management. However a Labuan entity carrying on a Labuan trading activity has the option of electing to be charged tax at a fixed rate of MYR20000 for.

Or b third party risks subject to Labuan FSAs approval. The financial activities including the management of investment portfolios accept of foreign currency deposits borrow or lend of money to Malaysian residents or to foreigners to purchase properties situated within the country which in Labuan case is Malaysia granting of loans to non-residents Islamic banking investment banking securitization leasing and others. Among others these include detailed explaination or clarification of rules governing the business and conduct of Labuan entities.

Labuan entities that carry on a non-Labuan business activity are subject to the provisions of the Malaysian Income Tax Act 1967 ITA. Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity.

The Midshore Jurisdiction About Labuan Ibfc Labuan Ibfc

Form Lfb Labuan Financial Business 2014

What Labuan Ibfc Can Offer Signature Trust

Https Www Labuanibfc Com Clients Labuan Ibfc 78c2ff81 703a 4caa 8926 A348a3c91057 Contentms Img Libfc A Guide To Gift 2020 6 Pdf

Komentar

Posting Komentar